Investing in small chunks💡

Managing Personal Finances- Part 1

Photo by Micheile Henderson on Unsplash

After graduating from college amidst the pandemic I was awestruck when I scrolled down the social media handles of my colleagues and the other online connections. What hit me is that on one side I see the uncontrolled expenses out of the monthly paycheque one receives from their respective jobs and on the other side the anxiety caused by the massive medical expenses which left hundreds of families in penury. It left me in another shock when I realized the medical bills in many cases were also much beyond the gross income of the family.

Is the situation because of the income differences between both parties or the big fat family burden in the later case added to their misery?

When I dug deeper I found out that although the above-mentioned factors are contributors it is merely half the reason of the financial breakdown. In most cases, both sides have more or less similar financial standing.

So how some part of the population is dealing with this financial crisis so well and the remaining are experiencing a storm of financial hardships?

It’s all about how you deal with money over time and have a broad understanding of it.

So in this series, I will be covering what young adults like us can do to handle our personal finances well and have a balance of spending and saving during the different phases of life.

Note: The information is partially based on my experiences over time and the expert’s advice in this domain through various articles and courses.

In this series, I will talk about an imaginary person named Noah and how she handles it all. Noah is 23 and just graduated from college👩🎓. She graduated from a public college with very little tuition which has covered all her minor loans.

However, during her college excursion in the final year, she planned a trip to Malaysia 🏝 with her friends where she spent around ₹40000. The money was borrowed from her parents with a promise to return them back.

So what affected Noah financial decisions in life and what could have been better?

During undergraduate, every student dreams of the nicest final year trip with the best of friends and so did Noah. However, her friend Sue spent around ₹30000 on the same trip and did not even carry any debt.

What caused the difference in financial status between the two although both shared the same student status in the same college?

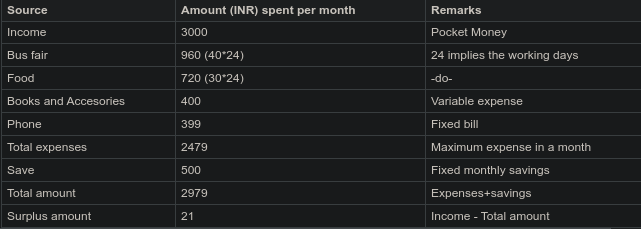

Here comes our first lesson in managing finances - Building a saving habit. Remember Noah and Sue and how both planned the same trip with completely under different financial standing. Let’s know something more about their background to help us analyse the situation better. Right from the first year of college both Noah and Sue was given pocket money of ₹3000 by their parents. Sue has an elder sister who advised her to make a budget right from Day 1 of her college to cover up her college excursion expenses. She did the same during all her working months she started saving ₹500 per month. It was around 1/6th of her pocket money. The following is how she made her budget for a regular working month in her journal.📒

There were days she could not save the entire amount but she managed to cut down her costs from the next month and aim for at least a ₹20 surplus every month. She was tracked by her sister during her initial days so that she doesn’t fall off her habit of saving.

On the other hand, Noah, although she doesn’t spend much, had no one to advise her to do the same and thus she ended up having a comfortable budget free month. Noah never kept track of her spending in a month and spent her surplus amount to treat herself at the end of each month. She feels treating herself motivates her to do well in the next month.

So who was correct or is there any right or wrong in their behaviour so far?

You might be inclined to think Sue was right but I say Noah was no wrong either. She felt motivated and happy with her daily life.

Although financially in a long run Sue was doing the right thing, Noah had a strong excuse of not being aware of the effectiveness of managing personal finances. The same is the case with most of us. We are just not aware!

So let’s continue the story…

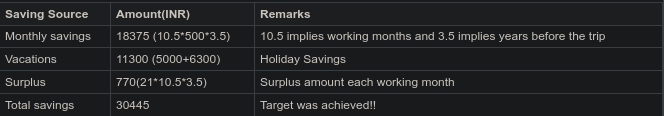

Sue kept saving for the next 3.5 years of her college years without fail. She was fortunate that her parents didn’t deprive her of the pocket money even during her vacations.

They had two vacations per year - the summer break which was a month-long and a winter break which was half a month long. Since Sue did her graduation in India more holidays added to her list. It was around 30 in number.

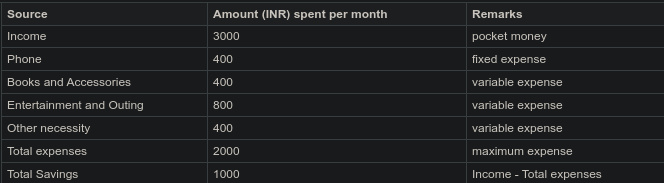

Some more calculations!! The table below shows her expenses in a month vacation.

So there were three summer holiday terms before she went for the trip and four winter holidays before her trip i.e 10003+5004 = ₹5000.

here were also 30 holidays per year which deducts her food and bus expenses which accounts for around (4030 + 3030) = ₹6300 for entire her college life.

Let’s calculate her savings before she leaves for her vacation.

Yes, I admit I did the calculations are a bit too accurate and its ofcourse tedious but it is just to give a gist of how small savings can help young adults achieve their bigger goals without much financial help from others.

The same procedure applies to all other smaller targets we want to have in our lives. For example, if we want to get a kindle that costs around ₹8000 then we can plan to save for that well ahead of time (say 4 months) and cut down a few expenses or take up a small paid task around us to help us achieve that target.

Setting small goals and saving for them regularly is a good and effective habit altogether, especially for young adults who rely on little or no stable income during the initial years.

There were times in Sue’s life when she desperately wanted to spend the money saved. Her elder sister even had a solution for this. She opened a separate account for her savings so that she could deposit her savings at the end of each month. Adopting this practice she became much more punctual over time to keep her money without fail in her account. (We will talk about different types of accounts in a later blog as we go along.)

Finally, she had all her excursion funds accumulated and could independently spend all the funds leaving behind all the worries of any debt.😃

This is how we can get started in the management of personal finances and create a rough saving and spending budget for our special short term targets in life.

To be continued in the next part focussing on the other concepts about personal financing. Stay tuned to know what Noah and Sue are up to now.