Preparing my Personal Balance Sheet 📝

Managing Personal Finances- Part 3

Overview of the previous part:

Six friends with different money personalities set out on a trip to Malaysia in their final year of college. Each managed their funds for this trip in different ways- some used their savings while others borrowed from their friends and parents.

Photo by Jerry Zhang on Unsplash

During their flight to Malaysia, they were all having a nice time chit-chatting about their life. John was really curious to know how Sue and Alene managed their expenses all alone for this trip. Alene confessed that she saved probably more than its needed and now trying to have a more balanced life than being an extreme “Money Hoarder”. However, Sue had an achievable habit that led to her self financed trip apart from her budget.

Sue maintained a “Personal Balance Sheet”. It gives her a perfect picture of how much she owes and how much she owns.

Personal Balance sheets are prepared either annually or half-yearly according to earnings and preferences. Some also like to call this the “Net Worth” of an individual. Sounds like a big fancy term?

On an individual level, it’s definitely not!

Net Worth = Assets-Liabilities

Assets = Market Value of anything you own

Liabilities = Value of anything you owe someone.

In this blog, I will mostly talk from a students perspective or anyone who has just started his or her career.

In laymen’s terms, if we converted all our assets to cash (market value only) and pay back all our debts, then the cash that will still remain with us will be our net worth.

** Remember market value is not what we paid when we bought an item but what we could sell it for.

So what actually I mean by assets?

Assets can be divided into three broad categories :

-

Monetary Assets: Cash which is practically present with us at the moment. For example-Money in our wallet, current and savings account balances or if a friend or family owes you some money.

-

Tangible Assets: These are assets that we can mostly hold physically. For example-Any personal property like a car, a bike, our electronics, instruments or even the furniture we own which we think are a sort of big cost items.

-

Investment Assets: These are mostly the assets whose value is generally growing with time. For example-Investing in stocks, bonds, mutual funds etc. It can even be a property on real estate or maybe employer-sponsored retirement accounts and other insurances. (Insurances that payout only after we die like life insurances do not count.)

The next important thing is liabilities or the debts we owe. Let’s now discuss that.

The following can be your liabilities:

- Any kind of current bills, credit card account balances or if we have taken any unpaid services that need to be paid later.

- If we have borrowed money from friends and family.

- Rental Utilities and other bills to be paid regularly.

- Car loans, college or student loans for education, home mortgages or any real estate type mortgages etc.

Now we are ready to put things down on our “Personal Balance Sheet.”

John was really fascinated to know about these concepts and starts thinking about his coming life. John secured a college placement in his final year and plans to join that job early next year. He is really interested now to calculate his net worth to help him manage his finances effectively and not to get trapped into the habit of being a “Money Spender”. He lists down his assets i.e. the money in his pocket and accounts, his electronics, furniture etc and valued everything to be just ₹15000. Next, he made a list of what he owes. It included the ₹10000 he took from Alene, a student loan of ₹300000 and some other borrowed money which accounts for a total of ₹318890.

Therefore, his net worth is

(Assets-Liabilities) = ₹15000-₹318890 = -₹303890( which is -ve 😨).

How come someone has a negative net worth? Isn’t that dangerous?

No, it is very natural, especially for young adults who are in the early part of their career but of course, we want that to change over our lifetime and increase our worth with time.

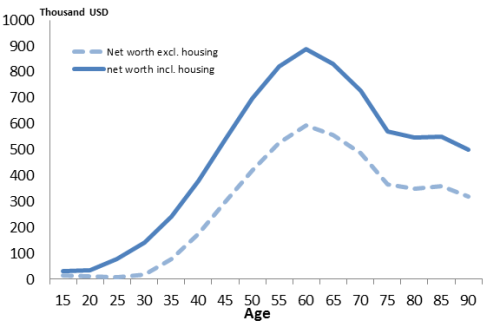

The graph of the life cycle for Net Worth is shown below:

The data is taken from Survey of Consumer Finances, averaged over 1989–2013.

In the graph, we see that the Net Worth starts pretty low and it grows as the career progresses. At a particular stage, our net worth shoots up and continue to grow till we retire. After retirement, we mostly use the accumulated funds which we have saved throughout our career.

The takeaway from the blog is “Personal Net Worth” is like a snapshot of our financial standing at the present time and thus calculating our net worth annually is a strategic financial tool to see where we are now and how can we progress over time.

References:

- Financial Planning for Young Adults by Coursera